How a TBR Can Save You Time and Boost Efficiency

Discover how a TBR can streamline your business with automation, AI, and e-signatures

VideoKeeping track of expenses can be a real pain, all those paper receipts and oddments, and trying to remember mileage. Why does it have to be like that?

In my business, I have three key tools that together automate and simplify expenses, making them quick, easy and painless.

Here are my tips on setting up your automated expense management system & expense management processes.

I use Xero as my accounts package and Xero can be integrated with many other tools so my expenses and mileage can be sent, recorded and reconciled easily, making the process of paying claims much more swift. That is the first of the three tools and the most important one which I recommend for automating expenses effectively.

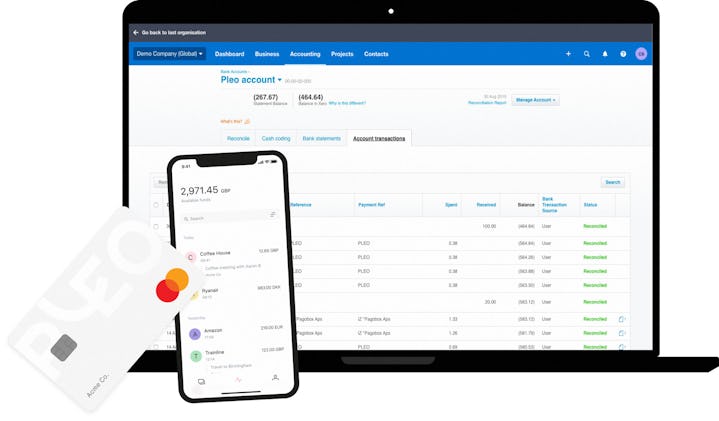

For this, I use Pleo which is a mobile app with a physical and virtual prepaid card. During every transaction using my payment card, I get an instant notification on my mobile to take a photo of the receipt and select what it is for. Parking, meetings and events, and even office supplies are captured straight away. No messing around with paper receipts later. No guessing what the faded and crumpled receipt says as you read it a few days before your expenses are due! And no time consuming messing with needing to reimburse employees.

Pleo shows as an account in your Xero dashboard, allowing you to keep tabs on the balance throughout the month. All you need to do is open Pleo weekly or monthly on your computer, review the transactions and import them into Xero to reconcile.

Once the system is set up, it quickly becomes a routine you find easy to follow.

Earlier this year I switched to TripLog after using MileIQ for the past few years. MileIQ uses the GPS on my phone to work out when I have travelled. Once the trip was recorded it allowed me to classify it as a personal or business expense for my accounts.

The problem is that using GPS can cause issues on any trip, in whatever vehicle or public transport you take, because once the trip is logged you need to clean up the data before you can use it for expenses. For example, let’s say you have a half day, you would need to reclassify any personal trips as they would have been recorded as business trips.

The other problem is that if you switch vehicles during the week, a standard GPS cannot differentiate between vehicles. This means you have to manually clean up the data before you create your expenses.

A standard GPS tracking device also fails to establish when you are travelling in a vehicle as a passenger, so again you need to delete or modify entries, creating more work for yourself.

Whilst TripLog offers the GPS option, it does something even better. The TripLog Beacon is a small USB you plug into your vehicle during the entirety of your TripLog plan. The TripLog app knows which vehicle you are using and can get a perfect start and stop time. They also have a more advanced version which has built-in GPS and can record trips even without your phone present, very useful for a pool car.

If you have more than one vehicle in your business you will need a USB for each one, allowing the system to automatically differentiate between vehicles each time it records a journey. And no more journeys as a passenger are recorded!

At the end of the month, all I need to do is review my trips and check if they have been classified as personal or business and then I can send the claim to Xero where it can be paid.

Mileage tracking doesn't need me to think about it during the day, it just happens accurately and automatically.

Both Pleo and TripLog save hours of admin work by making the processes automatic or very timely and easy to do, meaning I can focus on my business and my clients.

I can even say that these automatons have saved me money because I'm no longer missing expense claims, or struggling to read saved receipts. It is all accurately tracked for me at the time of the transaction, or trip.

If you are still struggling with your business expenses then I recommend automating the process, believe me, you won’t regret it!

John Fisher

Meet John Fisher, founder of Westway IT, passionate about helping businesses thrive with technology. With a BSc in Computer Science, he values integrity, education, and quality relationships. Active in The Tech Tribe and CompTIA, John simplifies IT and creates scalable strategies. Connect with him on LinkedIn.